-

4 Areas of Cyber Risk That Boards Need to Address

Technology & Operations Digital ArticleHow companies can build a long-term strategy that will keep them secure. -

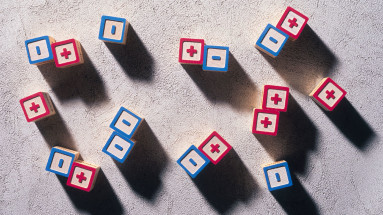

The Balanced Scorecard—Measures that Drive Performance

Balanced scorecard Magazine ArticleWhat you measure is what you get. Senior executives understand that their organization’s measurement system strongly affects the behavior of managers and employees. Executives also understand that traditional financial accounting measures like return-on-investment and earnings-per-share can give misleading signals for continuous improvement and innovation—activities today’s competitive environment demands. The traditional financial performance measures worked well […] -

How to Choose the Right Forecasting Technique

Financial analysis Magazine ArticleWhat every manager ought to know about the different kinds of forecasting and the times when they should be used. -

How Venture Capital Works

Finance & Accounting Magazine ArticleIn this article, Bob Zider, president of the Beta Group, a California-based firm that invests in commercializing new technologies, presents an analysis... -

Strategic Secret of Private Equity

Finance & Accounting Magazine ArticleThe huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms' aggressive... -

Strategies for Learning from Failure

Organizational Development Magazine ArticleMany executives believe that all failure is bad (although it usually provides lessons)-and that learning from it is pretty straightforward. The author,... -

Decision Trees for Decision-Making

Decision making and problem solving Magazine ArticleHere is a [recently developed] tool for analyzing the choices, risks, objectives, monetary gains, and information needs involved in complex management decisions, like plant investment. -

How to Create a Stakeholder Strategy

Global Business Magazine ArticleLately companies have come to recognize the limitations of the view that they must create value only for shareholders. Recognizing that every stakeholder... -

An Inconvenient Truth About ESG Investing

Investment management Digital ArticleIt might not actually work. -

Putting the Balanced Scorecard to Work

Balanced scorecard Magazine ArticleWhat do companies like Rockwater, Apple Computer, and Advanced Micro Devices have in common? They’re using the scorecard to measure performance and set strategy. -

Kodak’s Downfall Wasn’t About Technology

Disruptive innovation Digital ArticleWhat it missed was the business model. -

Business Marketing; Understand What Customers Value

Sales & Marketing Magazine ArticleIn this article, authors James Anderson, professor at the Kellogg Graduate School, Northwestern University, and James Narus, associate professor at the... -

How Venture Capitalists Make Decisions

Innovation & Entrepreneurship Magazine ArticleFor decades now, venture capitalists have played a crucial role in the economy by financing high-growth start-ups. While the companies they've backed--Amazon,... -

A Refresher on Net Present Value

Budgets and budgeting Digital ArticleKnow what your project is worth in today’s dollars. -

What I Learned from Warren Buffett

Financial analysis Magazine ArticleA book on Buffett spurs Gates to reflect on their friendship. -

Why Start-ups Fail

Innovation & Entrepreneurship Magazine ArticleIf you're launching a business, the odds are against you: Two-thirds of start-ups never show a positive return. Unnerved by that statistic, a professor... -

Contribution Margin: What It Is, How to Calculate It, and Why You Need It

Finance & Accounting Digital ArticleDo you know what your most profitable product is? -

Does the Capital Asset Pricing Model Work?

Finance & Accounting Magazine ArticleThe capital asset pricing model (CAPM) is a theoretical representation of the way financial markets behave. It can be used to estimate a company's cost... -

Everything You (Don’t) Want to Know About Raising Capital

Financial markets Magazine ArticleMost entrepreneurs understand that if the fundamentals of a business idea—the management team, the market opportunities, the operating systems and controls—are sound, chances are there’s money out there. The challenge of landing that capital to grow a company can be exhilarating. But as exciting as the money search may be, it is equally threatening. Built […] -

Ten Ways to Create Shareholder Value

Finance & Accounting Magazine ArticleExecutives have developed tunnel vision in their pursuit of shareholder value, focusing on short-term performance at the expense of investing in long-term...

-

A Note on, and a Tale About, Flexible Budgeting

Finance & Accounting Case Study8.95View Details This technical note introduces students to the concept, use, and mechanics of flexible budgeting. It is best used at the beginning of a course module... -

HBR 20-Minute Manager Collection (8 Ebooks) (HBR 20-Minute Manager Series)

For today's time-strapped manager or professional, setting aside time to brush up on key management skills is almost impossible. Luckily, Harvard Business... -

Cavendish Cove Cottages

Leadership & Managing People Case Study8.95View Details Sherry Noonan, a senior business student, is considering purchasing Cavendish Cove Cottages, a complex of 19 cottage rental units marketed to visitors.... -

UBS and Auction Rate Securities (C), Chinese Version

Finance & Accounting Case Study5.00View Details Supplement to 209119 and 209131 -

Americhem: The Gaylord Division (A-1)

Leadership & Managing People Case Study6.95View Details The Gaylord Division of Americhem, a large chemical company, is in the midst of the first use of a new zero-base budgeting system. The general manager... -

Board Director Dilemmas-New Year, New Timing

Leadership & Managing People Case Study8.95View Details This case focuses on a junior partner at a private equity (PE) firm who sits on the board of one of the firm's portfolio companies. In the case, the board... -

Designing Scotiabank's Project Fusion: New Branch Onboarding Technologies

Innovation & Entrepreneurship Case Study8.95View Details In February 2019, the associate product owner of the Branch Rapid Labs at the Bank of Nova Scotia (Scotiabank) was asked to provide his knowledge and... -

Pidilite Industries: Assessing Credit Quality

Finance & Accounting Case Study8.95View Details In mid-2015, a credit analyst with a leading investment company was tasked with assessing the overall credit quality of a chemical company that equity... -

Genmor Pharmaceuticals' Acquisition of Vascorex Corporation

Finance & Accounting Case Study8.95View Details This case asks students to identify and evaluate the merits of two factors that have led a buy-side analyst to conclude that an acquiring company is a... -

Business Process Reengineering: IT-Enabled Radical Change, Spanish Version

Technology & Operations Case Study8.95View Details Provides a conceptual framework for understanding business process redesign and change management. -

Mary Chia Holdings Limited: Sell or Hold?

Finance & Accounting Case Study8.95View Details Mary Chia Holdings Limited (MCH) was a provider of lifestyle and wellness services for women and men in Singapore and Malaysia. Listed on the Singapore... -

Zauner Ornaments

Finance & Accounting Case Study8.95View Details The primary purpose of this case is to provide students with an opportunity to practice the implementation of a simple activity-based costing (ABC) system.... -

Vyaderm Pharmaceuticals: The EVA Decision, Spanish Version

Finance & Accounting Case Study8.95View Details In 2016, the new CEO of Vyaderm Pharmaceuticals introduces an Economic Value Added (EVA) program to focus the company on long-term shareholder value.... -

The Campbell Home (C)

Sales & Marketing Case Study5.00View Details Campbell siblings Thomas and Sally are faced with selling their childhood home. They need to make several difficult consequential decisions, all the while... -

IFC Asset Management Company: Mobilizing Capital for Development

Finance & Accounting Case Study8.95View Details This case explores the International Finance Corporation's (IFC) creative and effective use of the private equity business model as a tool to mobilize... -

Publishing Group of America (B)

Finance & Accounting Case Study5.00View Details Supplements the (A) case. -

Finance Leadership in Novartis Consumer Health Businesses (Custom Version)

Leadership & Managing People Case Study8.95View Details Describes and contrasts the roles and challenges of three high-performing finance heads at Novartis Consumer Health businesses in Australia, Japan, and... -

Saving the Tuolumne: Sequel

Finance & Accounting Case Study5.00View Details In April 1983, the City and County of San Francisco and two irrigation districts in Merced and Stanislaus counties commissioned a feasibility study of... -

Debt Policy at UST, Inc., Japanese Version

Finance & Accounting Case Study8.95View Details UST, Inc. is a very profitable smokeless tobacco firm with low debt compared to other firms in the tobacco industry. The setting for the case is UST's... -

Perform Cost/Benefit Analysis, Spanish Version

Finance & Accounting ToolYou're considering investing resources to explore a new business opportunity. Discover how to use cost-benefit analysis to determine whether-and how well-your...

-

4 Areas of Cyber Risk That Boards Need to Address

Technology & Operations Digital ArticleHow companies can build a long-term strategy that will keep them secure. -

The Balanced Scorecard—Measures that Drive Performance

Balanced scorecard Magazine ArticleWhat you measure is what you get. Senior executives understand that their organization’s measurement system strongly affects the behavior of managers and employees. Executives also understand that traditional financial accounting measures like return-on-investment and earnings-per-share can give misleading signals for continuous improvement and innovation—activities today’s competitive environment demands. The traditional financial performance measures worked well […] -

How to Choose the Right Forecasting Technique

Financial analysis Magazine ArticleWhat every manager ought to know about the different kinds of forecasting and the times when they should be used. -

How Venture Capital Works

Finance & Accounting Magazine ArticleIn this article, Bob Zider, president of the Beta Group, a California-based firm that invests in commercializing new technologies, presents an analysis... -

Strategic Secret of Private Equity

Finance & Accounting Magazine ArticleThe huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms' aggressive... -

Strategies for Learning from Failure

Organizational Development Magazine ArticleMany executives believe that all failure is bad (although it usually provides lessons)-and that learning from it is pretty straightforward. The author,... -

Making Smart Investments: A Beginner's Guide

Finance & Accounting AdviceReduce the risk factor, increase the reward factor, and generate meaningful returns. -

How to Build Wealth When You Don’t Come from Money

You are worthy of wealth, despite the systems designed to keep it from you. -

Decision Trees for Decision-Making

Decision making and problem solving Magazine ArticleHere is a [recently developed] tool for analyzing the choices, risks, objectives, monetary gains, and information needs involved in complex management decisions, like plant investment. -

Everything You Need to Know About Stock Options and RSUs

Finance & Accounting AdviceJust like salary, you should negotiate equity compensation.